Transfer of Corporate Tax Losses Under UAE Tax Law: A Detailed Guide

The transfer of corporate tax losses under UAE tax law is a significant opportunity for businesses, especially those experiencing financial

The transfer of corporate tax losses under UAE tax law is a significant opportunity for businesses, especially those experiencing financial

The introduction of corporate tax in the UAE marked a significant shift in the country’s fiscal landscape, which has historically

The United Arab Emirates (UAE) is renowned for its business-friendly environment, and recent changes in the corporate tax landscape have

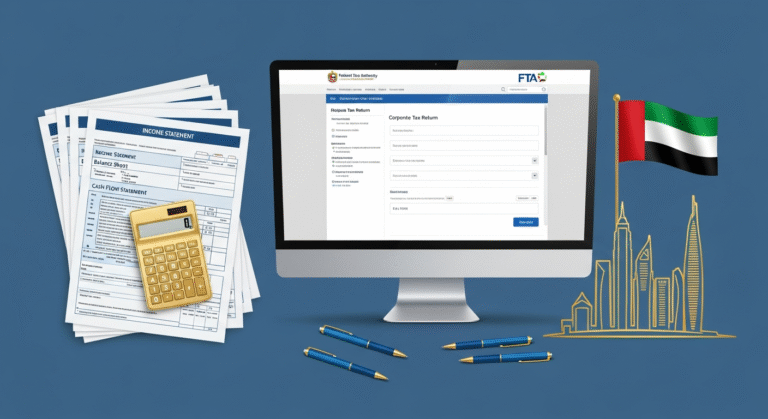

Corporate tax return filing is an essential aspect of running a business in the UAE, especially with the introduction of

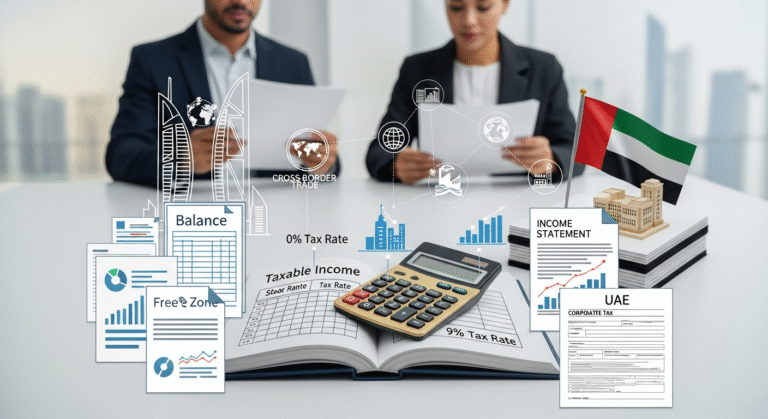

The United Arab Emirates (UAE) has long been a major hub for business and commerce, particularly in Dubai, a thriving

The United Arab Emirates (UAE) has long been a hub for business and investment due to its favorable tax environment.

The UAE has long been recognized as a tax-friendly jurisdiction for businesses. However, with the introduction of corporate tax in

In recent years, the United Arab Emirates (UAE) has introduced significant changes to its corporate tax structure, aimed at aligning

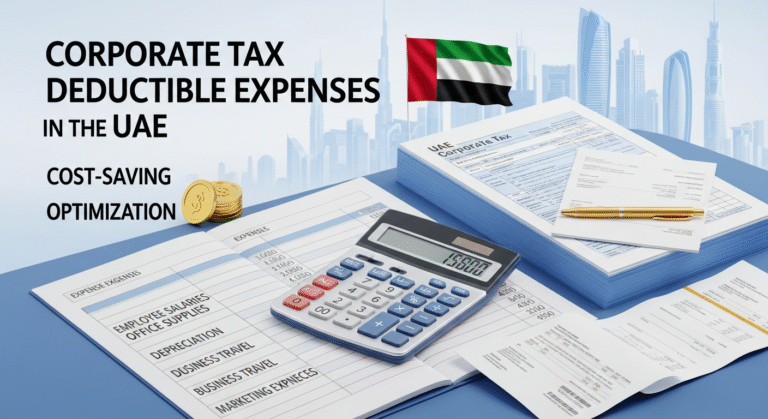

The United Arab Emirates (UAE) has long been known as a business-friendly destination, offering a diverse and robust economic environment

The UAE has undergone significant changes in its tax landscape in recent years, with the introduction of a federal corporate